Fuse Rebrands as Lorum to Rebuild Institutional Clearing

Fuse rebrands as Lorum, positioning as a specialist correspondent institution focused on institutional clearing and treasury infrastructure.

NY, UNITED STATES, December 9, 2025 /EINPresswire.com/ -- Global payment networks and schemes have continued to evolve, supporting faster and more connected transaction flows worldwide. At the same time, the institutional structures responsible for clearing and settlement have largely remained embedded within business models centred on lending, balance-sheet management, and yield optimisation.Today, Fuse announced its rebrand as Lorum, reflecting the company’s transition into a specialist correspondent institution focused on institutional clearing and treasury infrastructure for regulated financial institutions.

For decades, clearing functions have primarily operated inside full-service banks whose core business depends on deposit-taking and lending. When clearing is subordinated to balance-sheet priorities, institutions may experience slower settlement timelines, reduced transparency, and less predictable reconciliation processes. As organisations expand across markets, they are often required to manage fragmented correspondent relationships, local payment rails, and duplicated compliance structures.

The rebrand to Lorum follows a period of growth in transaction volume, geographic reach, and institutional usage. It clarifies the company’s role within the financial ecosystem as a provider of clearing and treasury infrastructure, rather than a front-end payments platform.

From Fuse to Lorum: Clarifying an Institutional Mandate

The transition from Fuse to Lorum reflects the company’s evolution from early infrastructure development into a dedicated institutional clearing and treasury partner. As the platform expanded across markets and regulatory jurisdictions, the original name no longer fully represented the scope or focus of its institutional role.

Everyone wants to talk about fixing SWIFT or replacing it with stablecoins, but SWIFT is just the messaging layer,” said George Davis, co-founder and CEO at Lorum. “The real friction is the chain of custody at the start and end of a payment. That is where timelines slip, controls get messy, and costs spiral. Lorum exists to fix the edges, not the network.

Unlike traditional banks, Lorum does not operate a retail banking or lending business. Its mandate is narrowly defined: to act as a specialist correspondent institution supporting clearing, cash management, and treasury infrastructure for regulated clients.

Institutional Clearing and Settlement Challenges

Many modernisation efforts in global payments focus on improving transaction initiation or messaging layers. However, the mechanics of clearing and settlement - including custody, safeguarding, and reconciliation - continue to be handled by institutions whose incentives are not always aligned with fast and predictable settlement outcomes.

When clearing functions are embedded within lending-focused institutions, organisations may encounter:

• settlement timelines influenced by internal liquidity management,

• limited real-time visibility across markets,

• manual or fragmented reconciliation processes,

• operational complexity as correspondent relationships scale.

Institutions expanding internationally often face increasing complexity as a result, managing multiple clearing arrangements with varying controls, timelines, and reporting frameworks.

Lorum approaches clearing from a different starting point: treating clearing as a standalone institutional function that benefits from dedicated infrastructure and governance.

A Specialist Correspondent Institution for a Multi-Market Environment

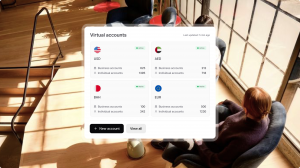

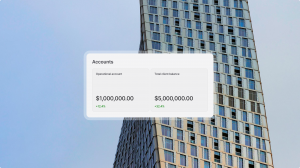

Lorum provides correspondent clearing and treasury infrastructure through a unified network spanning more than 30 markets. Through a single relationship and integration, regulated institutions can access local payment rails, multi-currency clearing, and named account structures without establishing separate banking relationships in each jurisdiction.

The platform supports institutions by enabling them to:

• clear and settle funds locally in major and domestic currencies,

• operate named customer and operational accounts across markets,

• centralise treasury and cash management functions,

• retain ownership of customer relationships and product design.

By consolidating these capabilities, institutions can reduce operational overhead while maintaining predictable settlement processes and intraday control.

Local Rails, Named Accounts, One Network

Through local licensing and direct access to domestic payment schemes, Lorum enables institutions to operate with named customer accounts in each supported market. Funds are collected and disbursed locally while remaining part of a single, consolidated treasury structure.

This model supports regulatory clarity and local safeguarding requirements, while helping institutions avoid the increasing complexity associated with fragmented correspondent banking arrangements.

For many organisations, market expansion can be managed through a single correspondent clearing relationship rather than the creation of new clearing structures in each country.

Built for Regulated Institutions and Operational Control

Lorum serves regulated institutional clients exclusively. It does not offer retail or consumer-facing payment products.

The company maintains the regulatory authorisations required to provide clearing, account infrastructure, and safeguarding services in the markets it supports. Lorum Finance (DIFC) Ltd is authorised by the Dubai Financial Services Authority (DFSA) and operates within established regulatory frameworks across its jurisdictions.

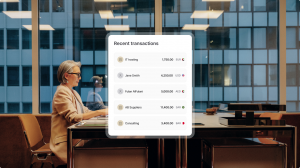

Institutional treasury teams require consistent control, auditability, and transparency. Lorum provides:

• real-time visibility into balances and flows,

• structured governance and reporting,

• bank-grade audit trails,

• operational controls designed for institutional scale.

These features reflect Lorum’s role as core financial infrastructure rather than a transactional application.

Industry Perspective

“Discussions about modernising payments often focus on front-end changes,” added Davis. “Clearing and custody frameworks play a critical role in determining how reliably and predictably money moves between institutions. Lorum’s focus is supporting that institutional layer.”

By concentrating on clearing and custody rather than transaction initiation, Lorum positions its platform as a foundational component within institutional financial operations.

Supporting Institutional Financial Platforms

Lorum supports a range of regulated institutional use cases, including:

• payroll and employer-of-record platforms,

• regulated fintechs and payment service providers,

• trading and investment platforms,

• global marketplaces operating complex payout models.

Across these use cases, institutions require reliable local settlement, centralised treasury oversight, and regulatory alignment across markets.

FAQ

1. What does Lorum mean by “institutional clearing”?

Institutional clearing refers to the processes that govern how funds are held, safeguarded, settled, reconciled, and released between financial institutions. These functions sit behind front-end payments and transaction initiation and focus on custody, settlement certainty, and operational control rather than user experience.

In practical terms, institutional clearing defines where funds are held at each stage of a transaction, which institution maintains control, and how settlement timelines are managed. This includes account structures, clearing relationships, safeguarding arrangements, regulatory alignment, reconciliation processes, and treasury visibility.

2. How is Lorum different from traditional correspondent banking?

Traditional correspondent banking typically relies on bilateral relationships with local banks in each market. Each relationship operates under its own processes, timelines, and balance-sheet considerations, which can vary across jurisdictions.

Lorum operates as a single correspondent clearing institution designed to support multi-market operations through a unified framework. Institutions work with one clearing partner that provides consistent account structures, settlement mechanics, and treasury visibility across supported markets, rather than maintaining numerous local relationships independently.

3. Is Lorum a bank?

Lorum is a regulated financial institution, but it does not operate as a traditional retail or full-service bank. It does not provide consumer banking services, accept retail deposits, or offer lending products.

Its institutional design is focused on clearing, account infrastructure, safeguarding, and treasury services. This scope allows Lorum to concentrate on operational reliability and governance within clearing and settlement activities.

4. Does Lorum provide payments or consumer financial services?

No. Lorum does not offer retail, consumer, or SME-facing payment products. It does not operate consumer payment applications, remittance services, or card programs.

Lorum provides institutional infrastructure that supports clearing and settlement behind financial products. Client institutions retain responsibility for customer relationships, user interfaces, and product delivery.

5. Which types of institutions work with Lorum?

Lorum supports regulated institutions that operate across multiple markets and currencies and require consistent settlement processes and centralised treasury oversight. Typical use cases include:

• financial technology platforms and payment service providers,

• payroll and employer-of-record (EOR) providers,

• trading and investment platforms,

• global marketplaces supporting multi-party payouts.

In each case, institutions require access to local settlement mechanisms alongside consolidated treasury management across jurisdictions.

6. How does Lorum support multi-currency and multi-market operations?

Lorum provides access to local payment rails and named account structures across more than 30 markets through a single correspondent relationship. Institutions can collect and disburse funds locally in major and domestic currencies while maintaining consolidated treasury oversight.

By centralising clearing and account infrastructure, institutions can manage multi-currency operations without establishing and maintaining separate local banking relationships in each jurisdiction.

7. Does Lorum hold or safeguard client funds?

Funds are held within appropriately structured accounts in accordance with local regulatory and safeguarding requirements. Lorum’s infrastructure is designed to provide transparency around custody arrangements and reconciliation processes.

Safeguarding is integrated into account structures and operational governance to support regulatory compliance and clarity around fund ownership and usage.

8. How does Lorum approach settlement timelines and predictability?

Settlement processes within traditional clearing models may be influenced by a range of internal operational or liquidity considerations. Lorum structures clearing activities separately from lending and deposit-based operations.

This approach is intended to support clearer settlement workflows, defined timelines, and consistent reconciliation processes across supported markets.

9. Is Lorum regulated?

Yes. Lorum operates within established regulatory frameworks applicable to its clearing and account infrastructure services. The company maintains the authorisations required to operate in the markets it supports.

Lorum Finance (DIFC) Ltd is authorised by the Dubai Financial Services Authority (DFSA), and the organisation operates in accordance with regulatory requirements relevant to institutional financial services.

10. Why did Fuse rebrand to Lorum?

The rebrand reflects the company’s evolution from early infrastructure development into a dedicated provider of institutional clearing and treasury infrastructure operating across multiple markets.

As the platform expanded in scale and regulatory scope, the Fuse name no longer fully reflected its institutional focus. The Lorum brand clarifies the company’s role, mandate, and positioning within the financial ecosystem.

About Lorum

Lorum is a specialist correspondent institution focused on institutional clearing and treasury infrastructure for a global, multi-currency economy. The company supports regulated financial institutions with access to local payment rails, named account structures, and consolidated treasury operations across more than 30 markets. Lorum was previously known as Fuse.

Media Contact

E-mail: hello@lorum.com

Website: https://www.lorum.com/

Address: Office 209, Building 24, Dubai Internet City, Dubai, United Arab Emirates

Marketing Team

Lorum

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.